Here at Virtual Done Well, we love to help business owners and companies address their accounting needs by providing them with access to highly professional virtual accounting assistants, which you might otherwise think of as freelance bookkeepers.

Indeed, that is what they are, with a few essential differences, or should we say benefits?

We’ll outline the advantages of our virtual assistants for accounting shortly, but first, let’s look at how freelance bookkeepers differ from those you would typically hire onto your staff payroll.

We’ll begin by exploring how freelance bookkeepers operate. Then we’ll do the same for the employed bookkeeper, and finally, we’ll summarise the primary differences between their operating models.

The Freelance Bookkeeping Business Model

Has your business reached the point where you must have financial professionals onboard to continue running effectively? Or perhaps you already have some and need more?

In either case, there are two options you are likely to consider:

Option 1. You hire a bookkeeper or accountant through the conventional approach, bringing the person into your team of employees.

Option 2. You choose to engage a freelancer.

A freelance bookkeeper is a service provider who will perform the same duties as an employed bookkeeper for an agreed fee but will not formally join your company or be included in your employee payroll.

The freelancer’s prices might be based on an hourly rate or, in some cases, charged as a project fee (usually applied only if you want the bookkeeper for a finite period, such as a month, six months, or a year).

Rates and Responsibilities

When you enter into a business agreement with a freelance bookkeeper, you will need to request his or her rates and fees, as the freelancer sets these, unlike in an employment contract where your company would determine the value of compensation for services received.

Of course, you may be able to negotiate with the freelancer, but ultimately, the freelancer is in control of setting rates, which will then be for your business to accept or reject.

With the rates agreed, you will be able to start working with your chosen freelance bookkeeper without worrying about taxation or other financial and legal complexities. Freelancers are responsible for calculating and paying their income tax, sometimes known as self-employment tax.

They are also obliged to manage their healthcare and other costs, meaning that your company will not have to provide healthcare, pension, or any other form of benefit above and beyond the agreed service fee.

How the Freelance Bookkeeper Works

When working with a freelance bookkeeper, you will need to accept that, although the freelancer is unlikely to have any employees working for him, he may outsource some of his tasks to other parties or service providers.

Nevertheless, as the primary contractor, the freelancer is responsible for ensuring that the output or results are commensurate with your business’s requirements, standards, and expectations.

You will not have the ability to dictate a freelance bookkeeper’s specific working hours, because freelancers are free to decide when and how many hours they work.

However, you will be able to specify to prospective candidates that you need services delivered between specific hours and on particular days of the week. The freelancer will then let you know if he or she is willing and able to comply with those needs.

Ultimately, provided you receive the output you expect within your specified deadlines, the freelancer’s actual working hours are for the freelancer—not you, the client—to manage.

Where the Freelance Bookkeeper Works

A freelance bookkeeper has the freedom to choose the location from which he or she will work. It’s possible to find freelance bookkeepers who can and will work on your business premises, but it is much more likely that you will hire a remote freelancer, perhaps even one based in a far-off country.

The beauty of today’s connected world is that professionals can perform activities like accounting and bookkeeping anywhere, as long as an Internet connection exists between freelancer and client.

You May Not Be the Only Client of a Freelance Bookkeeper

One more essential point to note about freelance bookkeepers is that they typically work with more than one client at a time. However, that does not necessarily have to be a drawback, provided your chosen freelancer can manage your work and those of other clients without jeopardising deadlines or compromising on quality.

Of course, the risk that the freelancer will take on too much work and that performance will begin to suffer as a result is ever-present.

Perhaps as much for this reason as any other, you might wish to consider pure freelance bookkeepers a contingent for specific projects or to cover the most hectic periods in your business calendar, rather than a permanent solution to your enterprise’s accounting needs.

The Bookkeeping Employee

You might be more likely to consider employing a part-time or full-time bookkeeper if you need a long-term or permanent solution for your business. So let’s look now at some key ways in which an employed bookkeeper differs from a freelancer.

The first big difference is that the employee works exclusively for your business, except perhaps in the case of a part-timer, who might hold down two or more jobs. In any case, you have absolute control over the way your bookkeeping employee spends the hours during which she is in your employ.

A full-time employed bookkeeper will work only for your company and be bound by an employment contract to perform work where, when, and how your business requires.

Many employees today, especially since the emergence of COVID-19, are executing their duties remotely, perhaps from their homes. Nevertheless, as an employer, you can choose whether you wish to permit remote working or insist that the bookkeeper works from your business premises.

It’s All in the Contract

In addition to specifying the location, hours, and nature of the employed bookkeeper’s work, the employment contract, which will be drawn up by your business team and signed by the successful job applicant, will also document the salary and benefits the employee will receive.

Conversely to a freelancer arrangement, it will be your company that specifies the value of your bookkeeper’s remuneration—and while you might be willing to accept some negotiation on the part of the successful candidate, you are under no obligation to do so.

You can pay your employed bookkeepers hourly or provide them with an annual salary broken into monthly payments. You can also elect to add extra financial remuneration through commissions and/or bonuses if you wish, but you will need to document all such benefits in the employment contract.

More Control, But More Obligations

As the employer, your business will be responsible for withholding taxes, like income tax, social insurance, or social security, from your employed bookkeepers’ paychecks and making the associated payments to your country’s governmental authorities.

In addition, you might also have to withhold contributions to other obligatory benefit systems such as unemployment insurance or workers’ compensation.

In general, then, the employed bookkeeper model will give you more direct control over your business’s accounting activities than in a freelancer agreement.

At the same time, it places more social and legal obligations on your company, involves a more complex recruitment and onboarding process, and typically costs more overall. For these reasons, the employed bookkeeper model is often best when you know you will need your bookkeeper indefinitely, with a horizon of at least a couple of years.

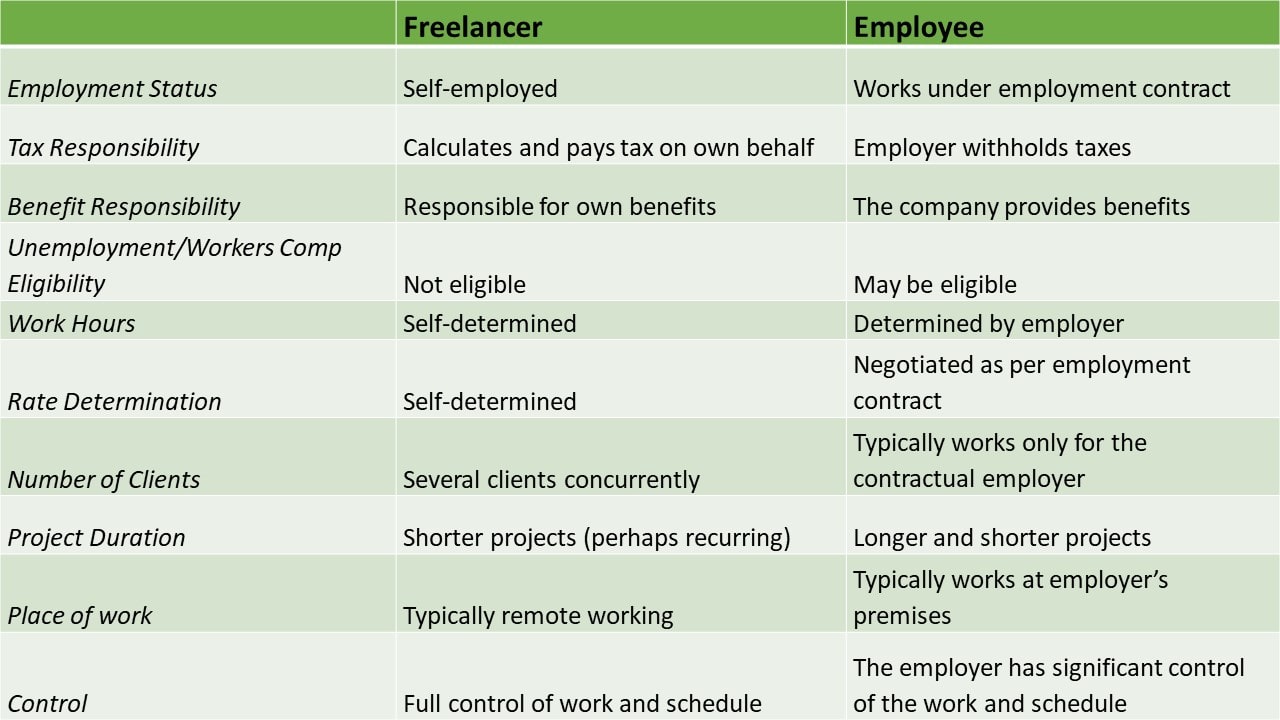

A Review of the Differences: At a Glance!

Here’s a quick and convenient reference chart highlighting the primary differences between freelance and employed bookkeepers.

This overview of the differences, along with the more detailed explanations in this article, should be helpful when deciding which option would best fit your business or organisation.

Before you opt for a freelance bookkeeper, though, if that’s the direction in which you lean, be aware that there is one other possibility offering similar cost and flexibility benefits—and a few more besides. We like to call them virtual accounting assistants.

The Extra Advantages of a VDW Virtual Assistant for Accounting

Have you decided that employing a conventional bookkeeper comes with too many obligations and is an overly rigid solution for your business?

If so, the next step will probably be to start scouring freelance workers’ platforms and other sources to find your remote-working accountant.

Before you do that, though, you might want to assess the extra advantages of hiring a virtual accounting assistant from Virtual Done Well.

Bookkeepers with (Extra) Benefits

At Virtual Done Well, we can offer the same benefits as you would receive from a freelancer, at a similar cost—but in addition, our virtual assistants provide greater assurances of service quality and continuity, due to the following features of our business model:

- Your bookkeepers work from our purpose-designed office facility, with a team of managers for support and guidance, and business-grade tools and systems to manage their tasks and activities.

- You have the confidence of knowing that power outages, Internet interruptions, and other technical problems will not stop your bookkeepers from providing their services. Our business facility has standby solutions for all such infrastructure issues.

- We will provide you with a stand-in bookkeeper to ensure uninterrupted service if your regular VA is absent due to sickness or other issues.

- We establish a formal and organized business-to-business relationship with you, which can be more convenient and straightforward than when you work with a self-employed freelancer.

- We can respond fast when you need to scale your accounting resources up or down, as we employ an entire team of bookkeeping virtual assistants.

- You can source all your bookkeepers from us, sparing you the time and effort needed to search for and recruit freelancers.

The above benefits are achievable because Virtual Done Well is a service provider that employs bookkeepers to work remotely for our clients. Our bookkeepers are not subject to the typical limitations of self-employed virtual assistants who work from their homes. They are backed up by an entire team of colleagues and the commercial solutions and systems that ensure total business continuity.

Freelance, Employed, or Virtual Done Well?

With awareness of the differences between employed and freelance bookkeepers, you can create, augment, or expand your company’s finance team with enhanced confidence. We hope this article has proved helpful in that regard.

Remember, though, that if the freelance option appeals, but you’d like the additional assurances offered by an organised commercial service provider, Virtual Done Well is here to help, wherever in the world your business is located.

To learn more about our services and how we can assist you, please visit our accounting services page, or you can always contact us right away if you’re keen to get started with a virtual accounting assistant from VDW.

Recent Comments